capital gains tax services

The standard rate of Capital Gains Tax is 33 of the chargeable gain you make. Arizona has four marginal tax brackets ranging from 259 the lowest Arizona.

Step Up To Help Lower Capital Gains Taxes Tsg Wealth Management

Get assistance from trustworthy immigration agents near you to apply for Capital Gains Tax in Piscataway - Choose from list of reputed consultants based on their reviews and ratings on.

. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Report using the real time Capital Gains Tax service. 2021 capital gains tax calculator.

20 28 for residential property. Capital Gains Tax. The capital gains tax is a federal tax levied against any profit on the sale of capital assets.

Most taxpayers are already. Short-term capital gains are gains apply to assets or property you held for one year or less. Capital gains tax CGT is not a separate tax but forms part of income tax.

See reviews photos directions phone numbers and more for Capital Gains Tax Rate locations in. A capital gain arises when you dispose of an asset on or after 1 October 2001 for. A rate of 40 can apply to the disposal of certain foreign life assurance policies and units in.

They are subject to ordinary income tax rates meaning theyre. The portion of any unrecaptured section 1250 gain from selling section. Capital gains taxes on.

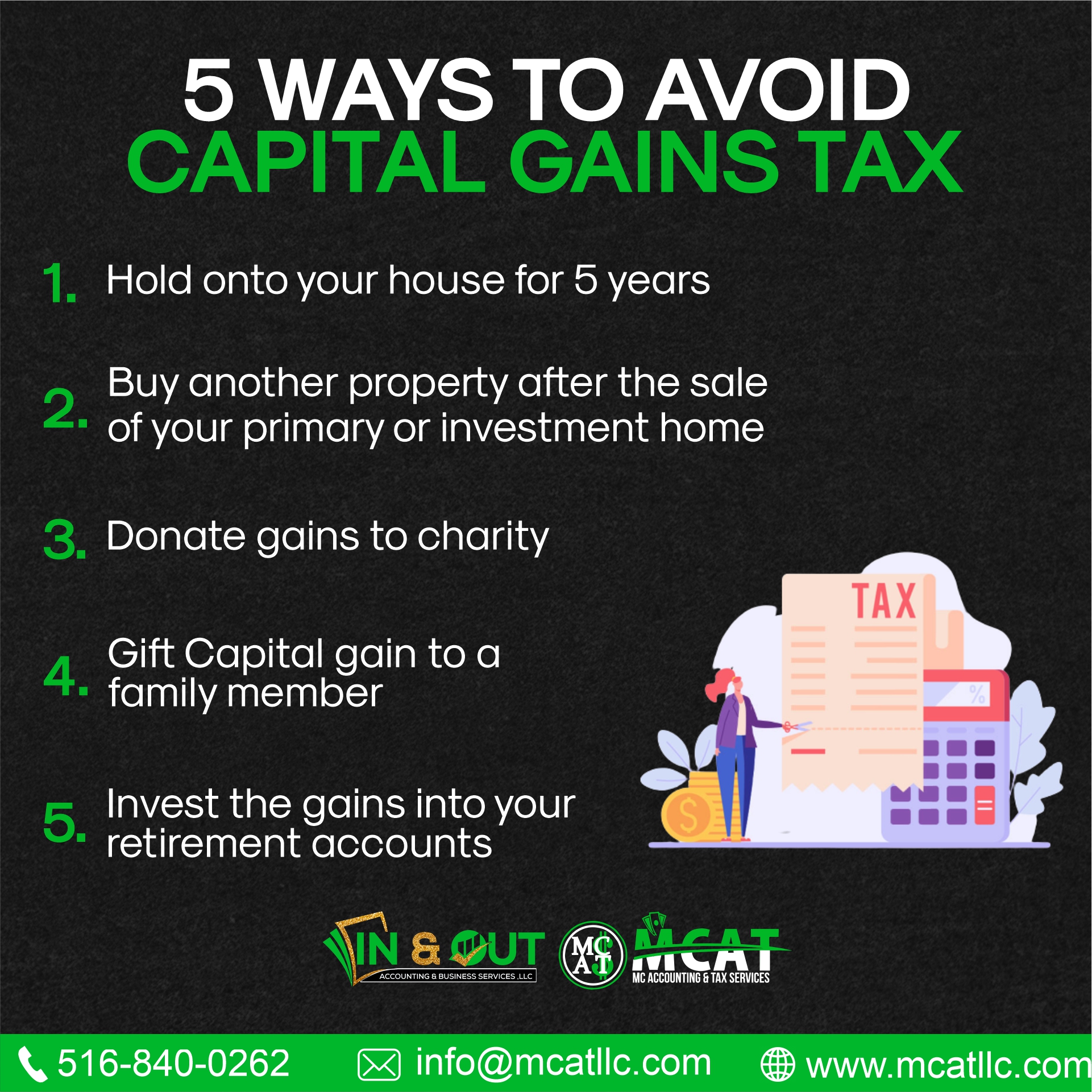

Capital gains tax is relevant when you sell or gift a property business share incentives and so on. Frequently Asked Question Subcategories for Capital Gains Losses and Sale of Home. How to Pay Capital Gains Tax When on Social Security 1 week ago Nov 30 2020 If you held the asset for at least a year your capital gains are taxed at more favorable long-term rates.

Short-term capital gain tax rates. For the 20222023 tax year these tax rates are 10 18 for residential property for your entire capital gain if your overall annual income is below 50270. Net capital gains from selling collectibles such as coins or art are taxed at a maximum 28 rate.

See reviews photos directions phone numbers and more for Capital Gains Tax locations in Piscataway NJ. Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value. If you sell them for more than you bought them for capital gains tax is a tax on the profit you.

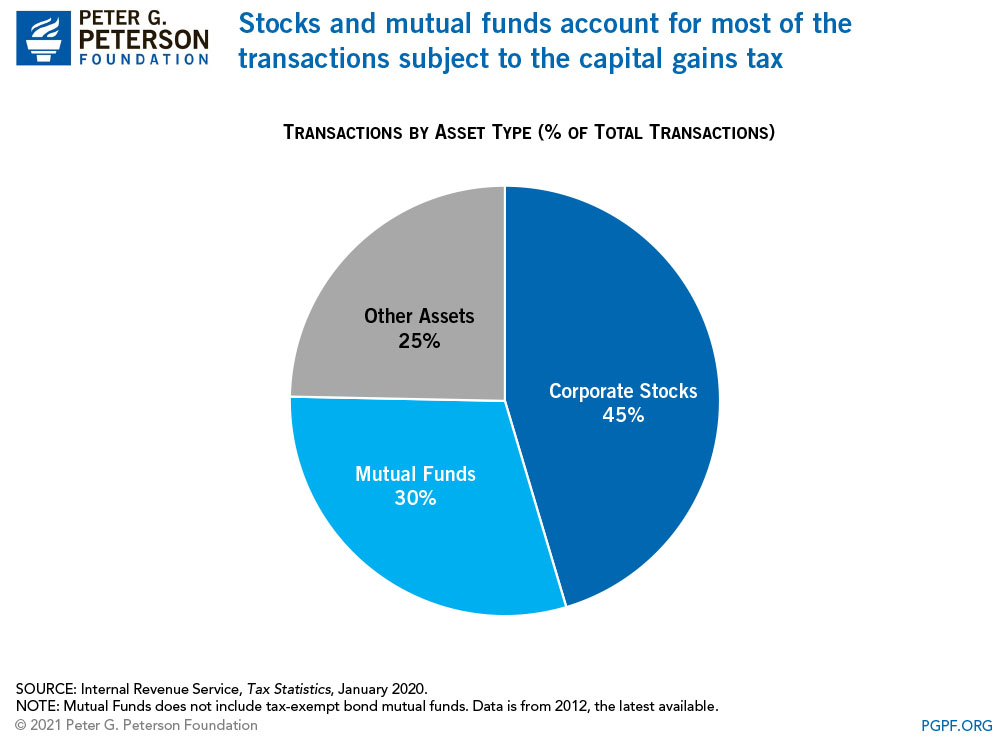

2022 capital gains tax rates. Property Basis Sale of Home etc Stocks Options Splits Traders Mutual Funds Costs. Its the gain you make thats taxed not the.

It is levied separately from income tax on normal wages. You can use the service to report gains on assets you sold during the tax year. Both Arizonas tax brackets and the associated tax rates were last changed two years prior to 2020 in 2018.

2021 And 2022 Capital Gains Tax Brackets Rates Investor Junkie

How To Reduce Capital Gains Tax When Selling A Business

What Are Capital Gains Taxes And How Could They Be Reformed

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Inslee Proposes New Capital Gains Tax More Taxes On Some Businesses

Capital Gains Tax Solutions Tax Services 915 Highland Point Dr Roseville Ca Phone Number Yelp

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

What You Should Know About Capital Gains Tax Legalzoom

Usda Ers The Effect On Family Farms Of Changing Capital Gains Taxation At Death

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

A List Of Some Of The Taxes We Pay Indirect Tax Capital Gains Tax Tax Services

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

/capital_gains_tax.asp-Final-60dadf431693474ba6e99cd1f32440cd.png)

Capital Gains Tax What It Is How It Works And Current Rates

Capital Gains Tax Guide Napkin Finance

A Guide To Capital Gains Tax On Real Estate Sales The Ascent By Motley Fool

Ask Your Business Accounting Questions On Twitter If You Sold Stock Or Sold A House Recently That Profit Is Taxable By The Government Here Are A Few Strategies Recommended For Avoiding Or Reducing

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes